Over the years being a licensed financial planner, many clients have asked me what is PRS. While some of them know that it is eligible for tax relief, what exactly is this investment scheme and what could it do for them in terms of personal financial planning other than tax deduction?

Regarding this question, the typical PRS consultant may answer, “PRS is good for everyone, and whoever is paying income tax must enrol into this programme, it helps you to save tax while doing investment to grow your retirement savings, the higher your income bracket, the more you save in tax, so we should enrol in this scheme.” This is the answer from First-Level Thinking perspective.

My answer as an independent licensed financial planner to this question might be slightly different from that. Apart from First-Level Thinking which only consider the tax savings perspective, we should also think in Second-Level Perspective, whether PRS fund you choose is selected from best of breed category that could provide an investment return better than other investment after taking into account of tax deduction benefits and is this scheme suitable for me considering other aspects of overall financial planning (As Financial Planning includes not only tax planning, but also cash flow management, investment planning, insurance planning, retirement planning and estate planning) I would probably tell you that the answer depends based on different circumstances and it might not be suitable for you after considering all aspects of your financial planning. Of course, I will raise some real scenarios to further elaborate my answer to this question.

Overall, there are 78 Private Retirement Scheme (PRS) funds in the market, according to Morningstar in August 2025. This number can change as new funds are introduced by different PRS providers over time. These funds are offered by various PRS providers with each funds provider offering a range of conventional and Shariah-compliant options to suit different risk appetites. For complete and up-to-date list of PRS funds available in the market, you can visit the official website of the Private Pension Administrator Malaysia (PPA).

In terms of whether it’s best of breed funds, what is the difference in your return when you didn’t do a close assessment of your selected PRS funds and just follow whatever best fund recommended by individual fund provider.

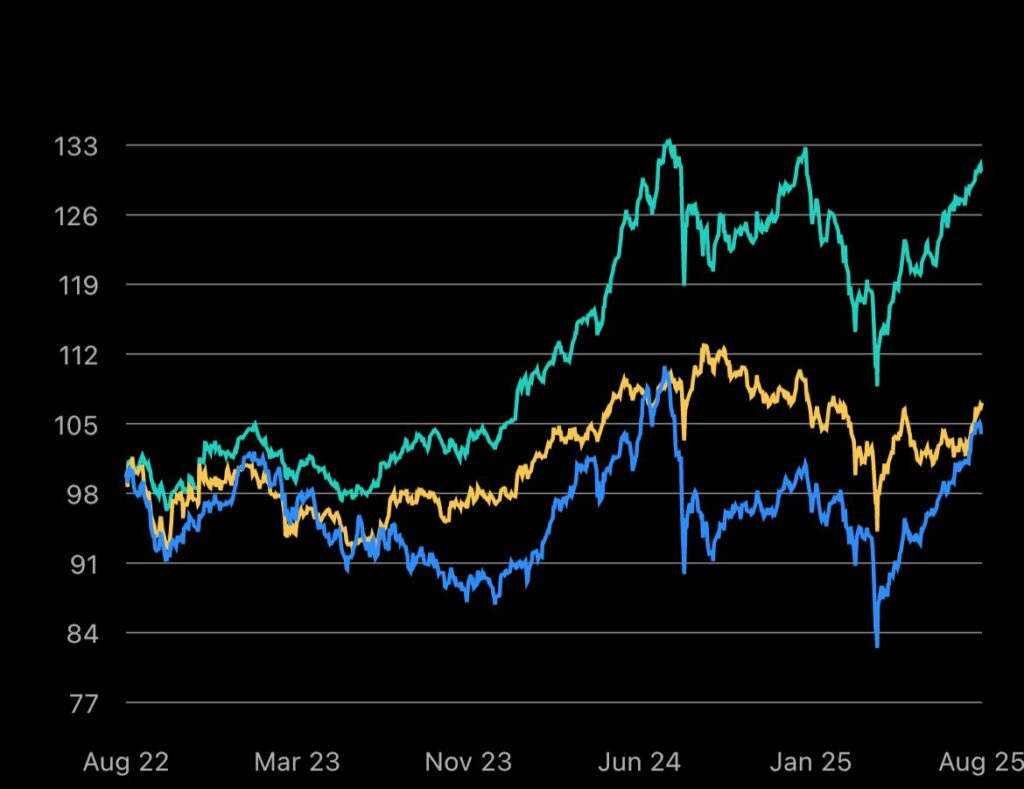

The graph above gives an overview of 3-Year Annualised Performance as of 25 Aug 2025. Yellow line represents KLCI Composite index while blue line (PRS Fund A) and green line (PRS Fund B) each represents one PRS fund from different fund providers.

3-Year Annualised Performance

KLCI Composite Index(Yellow line) : 2.41% p.a.

PRS Fund A (Blue line) : 0.93% p.a.

PRS Fund B (Green line): 8.73% p.a.

The KLCI Composite index serves as a benchmark for Malaysia securities market. From the graph above, you may see that PRS Fund B (Green line) has outperformed KLCI Composite Index (Yellow line) by +6.32% while PRS Fund A (Blue line) has underperformed KLCI Composite Index by -1.48% in the past 3 years. Taking into account of annual inflation rate as 3%, PRS fund A not only is unable to outperform the overall market index, it is also unable to beat the annual market inflation. Despite we appreciate the regulated investment scheme and the additional tax incentives provided by PRS, if the selected PRS fund did not perform better than passive market index, our money will still depreciate due to market inflation. Hence, it is important to choose a PRS fund carefully from not only one PRS fund provider but compared to the rest of the PRS funds and choose the best of breed to contribute for your retirement savings through PRS while enjoying the added rax relief incentive.

Other than that, we should consider our tax rate, years to retirement and our risk profile when we participate in PRS.

Assuming different scenarios as shown below, each case’s retirement age is set at 55 years old.

Case 1: Ms. M (Tax rate =1%, years to retirement = 35)

Case 2: Mr. A (Tax rate =25%, years to retirement = 20)

Case 3: Mr. D (Tax rate=30%, years to retirement = 3)

Ms. M has a relatively lower tax rate as compared to Mr.A and Mr.D due to lower chargeable annual income (RM5,001-RM20,000). Given her 1% tax rate, the tax savings is RM30 which it gives almost no tax benefit, but the real power is in compounding:

If Ms.M contributes RM3000 in the beginning of every year from age 20 until 55 (35 years total) at RM3,000 per year with 6% growth:

Total Contribution (beginning of each year) = RM105,000

Value at age 55 = RM354,363

Tax Savings over 35 years =RM 1,050 saved

Difference with and without PRS = RM250,413

As Ms.M has longer investment horizon as compared to Mr.A and Mr.D due to age advantage, she has a higher risk appetite to tolerate higher market volatility as well. Hence, should Ms.M invest in PRS? The answer is definite YES given the right choice of PRS funds that could generate a consistent return that beats market inflation. On the other hand, Ms.M should also have a suitable cash flow management (minimum six months emergency cash reserves) and insurance planning to protect her from financial distress prior to starting her investment to build her disciplined regular investment habit in long term.

Let’s look at Case 2, Mr.A has a tax rate of 25% which is much higher than Ms.M due to higher chargeable income (RM100,000-RM400,000). Given his 25% tax rate, the tax savings is RM750 which is relatively higher. Let’s look at the compounding effect:

Total Contribution (beginning of each year) = RM60,000

Value at age 55 = RM116,978

Tax savings over 20 years = RM15,000 saved

Difference with and without PRS = RM71,978

Even though Mr.A has a higher tax rate as compared to Ms.M, there is a big difference between the Value they receive at age 55 due to the compounding effect. However, Mr.A gets to enjoy higher tax savings and if he could utilise the tax savings to invest in high growth investments, it could contribute more to his retirement savings too. Hence, should Mr.A invest in PRS ? The answer is yes given the right choice of PRS funds that could generate a consistent return that beats market inflation. Other than that, Mr.A should also have a suitable cash flow management (minimum six months emergency cash reserves) and insurance planning to ensure he is well protected from life uncertainties.

Lastly, let’s look at Case 3. Mr.D has the highest tax rate among all which is 30%. However, when you look more in detail, you will notice Mr.D has only three years left to his retirement age. Despite he has the highest tax savings (RM900 per year), the total tax savings he enjoys is only RM2,700 as compared to RM15K (in Mr.A’s case). Besides, given that he is close to retirement, his ability to accept high volatility is also much lower as compared to Ms.M and Mr.A. If he opts for the same equity portfolio as Ms.M and Mr.A, his portfolio might still be in negative return should a financial crisis happens (-20% annualised return) when he reaches his retirement age.

Total Contribution (beginning of each year) = RM9,000

Value at age 55 =RM5,856

Tax Savings = RM2,700

Difference with and without PRS = -RM444

This shows that for short horizon cases, the benefits of putting money in PRS is limited as compared to long horizon with higher risk tolerance cases despite a lower tax savings. So, should Mr.D invest in PRS in this case, the answer is NO. However, if Mr.D chooses the best of breed funds within the conservative and moderate risk category which earns about 4% return, the benefits of investing in PRS still wins in the end. Let’s see the calculations as shown below:

Total Contribution = RM9,000

Value at age 55 = RM9,739

Tax Savings = RM2,700

Difference with and without PRS = RM3,439

In conclusion, while PRS is a great tool for tax savings and retirement savings accumulation, we should know which fund are we investing in and also review our funds choice closely to optimise our return in long run. Besides, we should not only focus on maximising our tax savings and not considering our investment horizon and risk tolerance. I hope this article gives you a clearer idea on how to utilise this investment tool wisely and if you still have other questions, feel free to comment below.

Pingback: How to Retire Worry-Free - Elsie The Financial Planner