A Real Case That Serves as a Wake-Up Call

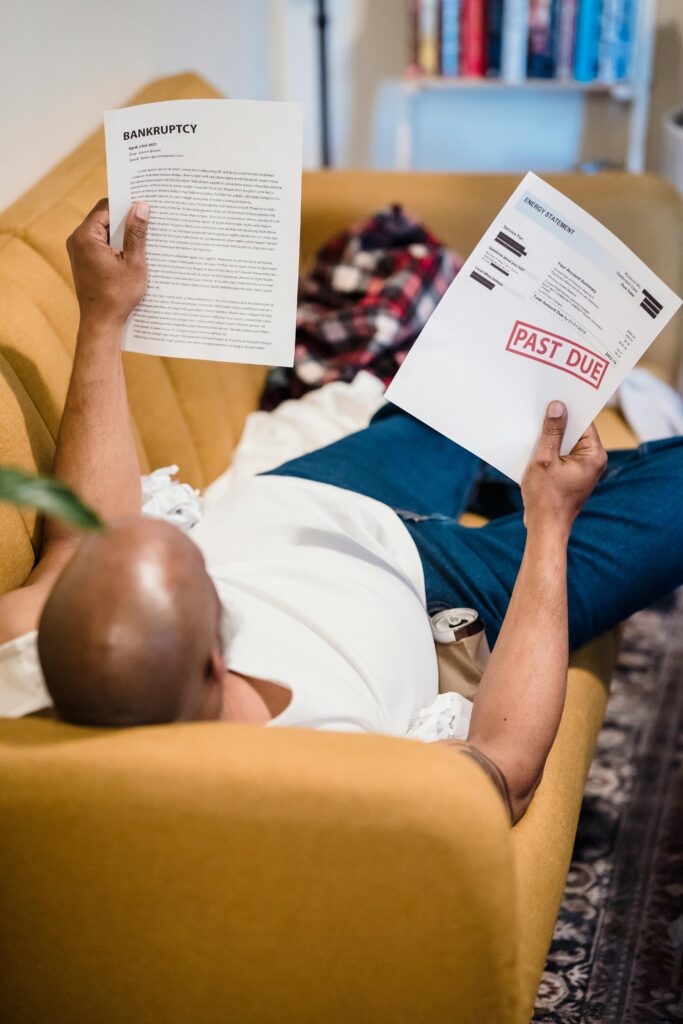

After working in Singapore for more than a decade, a middle-aged client realized only after being retrenched that his total assets were still less than RM100,000.

Years of hard work did not bring him security. Instead, it brought anxiety and helplessness.

What exactly causes someone to work so hard yet still fail to save money?

- No Saving Habit: Spending as Soon as Income Comes In

Without a consistent saving habit, money will always be “just enough” to be spent, regardless of how much you earn.

When retrenchment or illness hits, financial difficulties follow immediately.

So my first advice to this client was simple: make saving a priority and understand its importance and the proper way to save effectively.

- Working in a Sunset Industry Without Early Preparation

The more unstable an industry is, the more important it is to prepare an emergency fund early. In today’s rapidly advancing world, many jobs are becoming replaceable by AI.

Emergency funds ensure that during retrenchment or economic downturns, your quality of life is not compromised. They also give you a financial buffer to plan your next career move and choose a company that truly suits you.

A reminder:

If your current job does not require specialized skills such as machine operators or delivery riders then within a 20- to 40-year career span, you should continuously upgrade your skills, whether technical or managerial. Otherwise, a career crisis may leave you unable to find a suitable job quickly, prolonging unemployment.

- Lack of Emergency Fund Awareness

Emergency funds are not optional.

They are the basic safety net for your life.

Without them, any unexpected event can cause you financial disaster instantly.

Just like this client, he faced retrenchment and his elder’s sudden illness at the same time.

He has to burn the candle at both ends for months, working two part time jobs while taking care of his elder himself leaves him mentally and financially exhausted.

- Not Knowing One’s Own Financial Situation

If you don’t know where your money goes, how much debt you have, or how much your assets are worth, you will still unable to create an effective financial strategy.

Over time, it becomes impossible to save.

The first step in financial planning is understanding your asset and liability breakdown.

Only then you are able to plan effectively using your available cash flow.

- No Proper Insurance Planning

Without insurance awareness and proper coverage, a single illness or accident can wipe out years of savings and leave the family unprotected.

If the elder in this client’s family had understood the importance of insurance, they could have purchased disability and medical insurance while still healthy.

Insurance payouts could then have been used to:

- hire a professional caregiver at home,

- avoid burdening family members,

- or provide temporary income support to whoever needs to stop working to provide care.

This not only reduces medical costs but also prevents further financial pressure on the family.

- No Clear Investment Plan

Without investing, your assets will not grow and inflation will slowly reduce your purchasing power unconsciously. Eventually, your savings will shrink year after year.

If this client had invested properly during his stable income years, decades of compounding could have built him a decent retirement fund.

Unfortunately, due to lack of investment planning and no proper financial strategy, the client is doomed to face financial distress should there is any unforeseen event happens that cause him huge financial expenses.

A Final Reminder

This true story shows that financial freedom isn’t about earning a lot of money but it’s about knowing how to keep and grow what you earn.

Financial security is never about “luck”;

it is built on the right habits and proper planning.

As long as you start planning today, you can still build a richer and worry-free future for yourself.

Are you worried about your finances that may have similar risks?

If you want to:

✔ Understand your current financial status

✔ Build your emergency fund

✔ Plan your insurance and investments properly

✔ Keep your money and let it grow steadily

Feel free to schedule a complimentary consultation with me. I can help you with a complimentary financial check-up to let you know where you currently stand and what your next steps should be. Rest assured that I won’t charge any fee for knowledge sharing and I am sure you will benefit from this session.

Don’t wait until a crisis forces you to change.

Now is the best time to start planning for yourself.